Canara Bank Revises Home, Other Loan Interest Rates: Check How Much EMIs Will Go Up

The overnight MCLR was raised by Canara Bank by 35 basis points to 7.90 percent, and the one-month MCLR was raised by 45 bps to 8 percent.

Trending Photos

) File Photo

File Photo New Delhi: The Repo Linked Lending Rate (RLLR) and Marginal Cost of Funds Based Lending Rate have been updated by Canara Bank (MCLR). According to the bank's BSE filing, the increased interest rates will take effect on March 12, 2023.

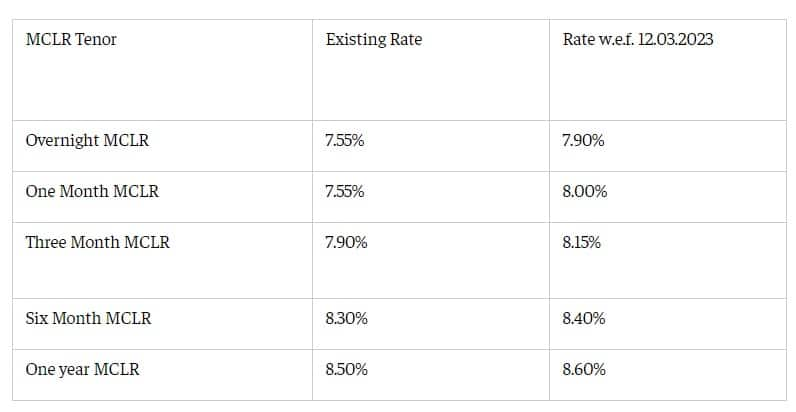

The overnight MCLR was raised by Canara Bank by 35 basis points to 7.90 percent, and the one-month MCLR was raised by 45 bps to 8 percent. (Also Read: iPhone 14, iPhone 14 Plus Soon In BRAND New Yellow Colour! Here's How To Prebook in India)

The six-month MCLR has climbed from 8.30 percent to 8.40 percent, while the three-month MCLR has increased by 25 bps to 8.15 percent. The bank raised the MCLR for a single year from 8.50 percent to 8.60 percent. (Also Read: Today's 'Vishwakarmas' Can Become Tomorrow's Entrepreneurs: PM Narendra Modi In Post-Budget Webinar On PM VIKAS)

Below is the table of raised Canara Bank's MCLR:

For the unversed, below is the list of banks that hiked MCLR in March 2023

HDFC Bank

The MCLR across tenures has increased by 5 basis points at HDFC Bank.

ICICI Bank

Throughout all tenures, ICICI Bank has hiked by up to 10 basis points.

PNB, Bank of India, Yes Bank

In March, several other banks, including PNB, Bank of India, and YES Bank, increased their MCLR.

RBI Hiked Repo Rate On February 8

The RBI agreed to hike the repo rate by another 0.25 percent at its monetary policy meeting on February 8, 2022, prolonging borrowers' agony of escalating loan interest rates. Since May of last year, the central bank has increased the repo rate six times in a row. As a result, between May 2022 and February 2023, the repo rate increased generally by 2.5 percent, from 4 percent to 6.5 percent.

Even though the RBI has increased rates once again, the amount of increases has gradually decreased over the course of the last three MPCs, from 50 bps to 35 bps to now 25 bps.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Live Tv

)

)

)

)

)

)

)

)

)

)