Good News for Senior Citizens! Now earn more from Senior Citizen Savings Scheme

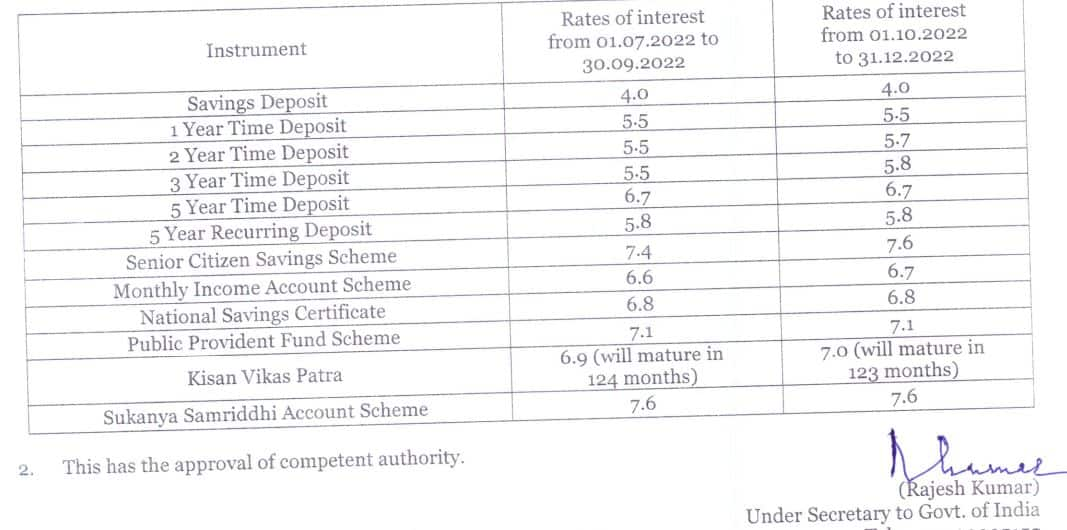

The government has revised rates of interest on various Small Savings Scheme for the third quarter of the financial year 2022-2 starting from 1st October, 2022 and ending on 31st December, 2022.

- The government increased rate of interest on key saving schemes

- Senior Citizen Saving Scheme witnessed a hike of 20 bps

- Kisan Vikas Patra saw change in interest rates as well as maturity tenor

Trending Photos

) Senior Citizen Savings Scheme will now offer an interest rate of 7.6 per cent.

Senior Citizen Savings Scheme will now offer an interest rate of 7.6 per cent. In good news for senior citizens, the government has increased the interest rate offered on Senior Citizen Savings Scheme in a bid to make it more lucrative. "The rates of interest on various Small Savings Scheme for the third quarter of the financial year 2022-2 starting from 1st October, 2022 and ending on 31st December, 2022 have been revised," said the Department of Economic Affairs in an office memorandum. Department of Economic Affairs comes under the Ministry of Finance.

As per the new rates, the Senior Citizen Savings Scheme will now offer an interest rate of 7.6 per cent, up from 7.4 per cent for the previous quarter. The government has increased the rates by 20 basis points.

The notification also showed that the government has increased the interest rate on two-year time deposits by 20 bps, from 5.5 per cent to 5.7 per cent and by 30 bps on three-year time deposits from 5.5 per cent to 5.8 per cent.

Also Read: Personal loan, home loan EMIs of these banks get costlier; Is your lender also on the list?

The government also hiked the interest rate on the Monthly Income Account Scheme to 6.7 per cent from 6.6 per cent earlier.

In a move that will help farmers earn more, the government also increased the interest rate on Kisan Vikas Patra to 7 per cent with a maturity tenure of 123 months from an earlier 6.9 per cent with a maturity period of 124 months.

On the other hand, the government has left unchanged interest rates of Sukanya Samriddhi Yojana (SSY), Public Provident Fund (PPF), National Savings Certificate (NSC), one-year time deposit and 5-year recurring deposit.

The new interest rates have come into effect from October 1 and will be applicable only for the third quarter of the ongoing financial year.

Stay informed on all the latest news, real-time breaking news updates, and follow all the important headlines in india news and world News on Zee News.

Live Tv

)

)

)

)

)

)

)

)

)

)